Release Notes

End of support for Microsoft Office 2013 and Microsoft Internet Explorer 11

As we have been announcing since May 2021, in particular in an article of our Knowledge Base as well as the e-mails sent last May, starting in November 2021, Wolters Kluwer will discontinue support for Microsoft Office 2013 and Microsoft Internet Explorer 11.

For more information, consult our Knowledge Base article End of support for Microsoft Office 2013 and Internet Explorer 11. An upgrade of your system may be required.

End of support for Windows 32-bit versions

As announced in the Windows 10 version 2004 system requirements, Microsoft stopped releasing 32-bit versions of operating systems. Therefore, please note that the versions of our software, which will be released in December 2022, will have a 64-bit architecture, and will no longer support 32-bit operating systems. Therefore, Taxprep will no longer operate on 32-bit operating systems.

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About

We are pleased to provide you with the second version of Taxprep for Trusts 2022. This version covers taxation years ending between January 1, 2021, and December 31, 2022, inclusive.

Note that client files have an extension reflecting the taxation year end of the trust: .321 for a taxation year ending in 2021 and .322 for a taxation year ending in 2022.

The rates applicable to the 2022 taxation year are those known as of February 23, 2022. Any changes resulting from subsequent federal, provincial and territorial announcements will be integrated into future updates of the program.

You can view the applicable rates by accessing the Table of Values Used in the Return found in the program (Jump Code: RATES FED-PROV).

Converting Preparer Profiles

Once your preparer profiles from last year are converted to the current year, it is important to verify that the options defined with respect to the returns of your clients and to the electronic filing of data (EFILE) still correspond to your situation for the current season.

For more information on rolling forward client files, please consult the Help.

Electronic Filing

Government requirements

At the federal level and in Québec, any filer filing more than 50 slips or RL slips of a same type must file the data electronically by Internet. Below that threshold, paper filing is accepted.

Taxprep for Trusts will generate a diagnostic prompting you to use EFILE as soon as you prepare more than 50 slips or RL slips.

Important dates for Internet transmission

The CRA has been accepting electronic transmissions of T3 and NR4 slips since January 10, 2022. Revenu Québec has been accepting transmission of RL-16 slips since November 15, 2021.

Please note that you can no longer use the CRA’s Filing by Internet file transfer (XML) service to electronically transmit a T3 return, as this type of transmission has not been supported by the CRA since December 23, 2021.

The CRA will make available the electronic transmission of the T3 Trust Income Tax and Information Return using EFILE. However, at the time of writing, the opening date of this service was not yet known. The transmission of T3 returns using EFILE will be available in Taxprep for Trusts 2022 only when the T3 EFILE service will be open. For more information on this matter, please see the Federal – T3 EFILE article.

Opening and Rolling Forward Files

Client files with the .321 extension

Client files with the .321 extension that have been saved with Taxprep for Trusts 2021 can be opened with Taxprep for Trusts 2022 without having been rolled forward first. When opening that file, a dialog box displays and asks you if you want to recalculate the file with the current version. By answering yes, you can simply continue working in the file. If you answer no, the data in the file will be locked. It can be unlocked at a later date using the Properties dialog box (File/Properties command).

Client files with the .320 extension

Client files with the .320 extension that have been saved with the 2020 or 2021 version of the program must be rolled forward by using the Roll Forward command in the File menu before you can access them from this version. Remember that in cases where client files were saved with the 2020 version, the roll forward is only possible if the taxation year in the source client file ends in 2020.

Taxprep for Trusts 2022 also allows you to open, without having been rolled forward first, a client file with the .320 extension. However, the file will only be read-only accessible. To open a client file with the .320 extension, access the Open dialog box (File/Open command), and select the directory where the client file has been saved using the Look in: drop-down list. Then, enter “*.*” in the “File name:” box and press Enter to display the list of client files. You can then select and open the client file you want to access.

Taxation year after roll forward

The taxation year after a roll forward cannot end after December 31, 2022. If needed, it will be shortened so as to correspond to the period covered by this version.

Attached notes

The attached notes are rolled forward, except if this option is cleared in the roll forward data options.

Rolling forward client files prepared with ProFile

Taxprep for Trusts 2022 allows for the roll forward of client files saved with version 2021.0 of ProFile (.19R extension).

Version 2.0 Content

Modifications

ID, Trust Identification and Other Information (Jump Code: ID)

The Questions used for EFILE only section has been added to allow you to enter answers to questions that are required in certain specific situations for purposes of EFILING the T3 return (Jump Code: J).

In addition, for purposes of filing the T3 return, the custom question Has the name of the trustee changed since the last time the CRA was notified? has been added to the Trustee(s) identification section, as the answer to this question is mandatory for the electronic transmission. Note that the answer to this question defaults to No.

Preparer Profiles

The following fields have been added to Section F of the PROFILE tab to allow you to enter information regarding the communication with the CRA during a pre-assessment or post-assessment review for all client files:

- Authorization granted by all trusts to allow the CRA to contact the electronic filer directly in order to request any supporting documents when the return is selected for pre-assessment or post-assessment review

- This authorization will expire on

- Pre-assessment review contact code

- Post-assessment review contact code

T3, Trust Income Tax and Information Return (Jump Code: T3)

For purposes of filing the T3 return the custom question Has the name of the trustee changed since the last time the CRA was notified? has been added to the Trustee(s) identification section, on screen only, as the answer to this question is mandatory for the electronic transmission. The answer to this question is updated with the answer to the custom question that was added to the Trustee(s) identification section of Form ID (Jump Code: ID).

T3M, Environmental Trust Income Tax Return (Jump Code: T3M)

Custom question Is this an amended return? and the field Specify the country (if other than Canada) have been added to the Identification and other information section, on screen only.

In addition, for purposes of filing the T3M return, custom question Has the name of the trustee changed since the last time the CRA was notified? has been added to the Trustee information section, on screen only, as the answer to this question is mandatory for the electronic transmission. The answer to this question is updated with the answer to the custom question that was added to the Trustee(s) identification section of Form ID (Jump Code: ID).

When opening a return prepared with a prior version of Taxprep for Trusts, the negative values that were entered on lines 010 and 095 will not be retained. In addition, only the first 60 characters will be retained in the Name of trustee and Address fields of the Trustee information section.

T3S, Supplementary Unemployment Benefit Plan Income Tax Return (Jump Code: T3S)

The custom question Has the name of the trustee changed since the last time the CRA was notified? has been added to the Trustee identification section, on screen only. The answer to this question is updated with the answer to the custom question that was added to the Trustee(s) identification section of Form ID (Jump Code: ID).

When opening a return prepared with a prior version of Taxprep for Trusts, the negative values that were entered on lines 241, 010, and 095 will not be retained. In addition, the Account number field, which is derived from the Trust account number field of the Identification form (Jump Code: ID), is now protected. As a result, if a number has been entered using an override, it will not be retained. Finally, for non-individual trustees, only the first 60 characters will be retained in the Address fields of the Trustee information section and in the Information about the trust section as well as the Name of plan field of the Identification and other information section. Also, for non-individual trustees, only the first 50 characters will be retained in the City fields of the Trustee information and Information about the trust sections.

EFILE, T3 Return Electronic Filing Worksheet (Jump Code: EFILE)

The following fields have been added at the beginning of the Preparer Profile Information section:

- Does the trust authorize the CRA to contact the electronic filer directly in order to request any supporting documents when the return is selected for a pre-assessment or post-assessment review?

- This authorization is limited to the specific tax year and will expire on

- Pre-assessment review contact code

- Post-assessment review contact code

These new fields are used for electronic filing purposes only and allow you to indicate whether the CRA should communicate with the tax preparer or with the trust when a return is selected for a pre-assessment or post-assessment review.

The exclusion conditions for the electronic filing of the T3 return have been amended.

The following lines have been removed:

- The amount on lines 56, 84, or 94 of T3 return is different from $0.00.

- The trust is a specified investment flow-through (SIFT) trust (code 028).

- The trust is subject to deemed dispositions as detailed on Form T1055, Summary of Deemed Dispositions.

- The trust is reporting a gross-up amount of dividends on line 49 of the T3 return.

- The trust is reporting reserves on Schedule 2, Reserves on Dispositions of Capital Property, or in area 1170 of Schedule 1, Dispositions of Capital Property.

- The trust is reporting designations of taxable capital gains eligible for deduction on line 930 of Schedule 9, Income Allocations and Designations to Beneficiaries.

- The trust is subject to minimum tax and has a net adjusted taxable income for minimum tax (field 12270 of Schedule 12, Minimum Tax) that is greater than 0.00.

- Did the trust file for bankruptcy and is filing its pre- or post-bankruptcy return?

The following lines have been added:

- The Trust that is filing or reporting the following forms and/or returns is excluded from EFILE:

- T3D – Deferred Profit-Sharing Plan (DPSP) or Revoked DPSP

- T3P – Employees' Pension Plan

- T3PRP – Pooled Registered Pension Plan (PRPP)

- T3RI – Registered Investment

- T3GR – Group Income Tax and Information Return for RRSP, RRIF, RESP or RDSP Trusts

- T1061 – Canadian Amateur Athlete Trust Group

- Section 216 Returns

- T3A – Request for Loss Carryback by a Trust

T3 NB-SBI, T3 New Brunswick Small Business Investor Tax Credit

T3SK CG, Saskatchewan Farm and Small Business Capital Gains Tax Credit (Trusts)

T3PFT, T3 Provincial or Territorial Foreign Tax Credit for Trusts

-

Form T1273, Statement A - Harmonized AgriStability and AgriInvest Programs Information and Statement of Farming Activities for Individuals is excluded from T3 EFILE.

-

Form T1163, Statement A - AgriStability and AgriInvest Programs Information and Statement of Farming Activities for Individuals is excluded from T3 EFILE.

- Income tax paid to more than three foreign countries on Form T3FFT, T3 Federal Foreign Tax Credits for Trusts.

- The trust is filing more than 12 Selected Financial Data (SFD) forms.

- The trust is submitting a claim for the return of fuel charge proceeds to farmers tax credit.

EFILE, T3 Return Summary of EFILE Data Fields (Jump Code: EFILE SUM)

This custom form has been modified to include both the information and data in the T3 return (Jump Code: J), its schedules, and Forms T184, T1055 and T2000 that are EFILED to the CRA with the T3 return.

Schedule 15, Beneficial Owner Information of a Trust

Schedule 15 is not included in the 2021 version of the T3 return (Jump Code: J). The CRA will only administer the new reporting and filing requirements once the legislation receives Royal Assent.

Schedule 15 had been released to the public a few weeks ago and has since been removed. As a result, we have been asked to remove the schedule from our program as well.

MR-14.A, Notice Before Distribution of the Property of a Succession (Jump Code: QMR-14A)

As a result of an update, significant changes have been made to this form:

- The form has been entirely renumbered.

- Part 4, Distribution type, and Part 6, Post-death income, have been added to the form.

- In Part 2, you are now required to indicate whether the recipient of correspondence is the first liquidator (box 10b) or a designated person with a power of attorney (box 10c).

- Information on the address, i.e., apartment, number, street, etc., is now presented in several boxes in Parts 1 and 2.

- In Part 2, if the liquidator is an individual, the first and last names must be entered separately in boxes 13a and 13b. If the liquidator is other than an individual, the name must be entered in box 12. Boxes 13a and 13b will then correspond to the name of the contact person.

- In Part 5, Patrimony at the time of death, the wording of several lines has been modified. Certain lines have been added while others have been deleted or merged.

If you completed this form using a previous version of the program, we recommend that you review the entire form before filing it.

SFD (T776), Selected Financial Data Record (Jump Code: SFD T776)

SFD (T2042), Selected Financial Data Record (Jump Code: SFD T2042)

SFD (T2125), Selected Financial Data Record (Jump Code: SFD T2125)

These three new multicopy custom forms include all information and data EFILED with the T3 return (Jump Code: J) for all applicable corresponding Forms T776 (Jump Code: 776), T2042 (Jump Code: 2042) and T2125 (Jump Code: 2125).

T3QDT-WS, Recovery Tax Worksheet (Jump Code: T3QDT-WS)

Previously, the 2016 and subsequent taxation years were indicated in the T3QDT-WS form, i.e., a column for each taxation year since a qualified disability trust has been subject to the recovery tax. In the most recent update of the form, the years that were indicated by default have been removed and replaced with boxes located above the columns in which the taxation years must now be manually entered. As a result, only the taxation years covered by the return should be entered on the form and the amounts for a year that has already been included in the recovery tax calculation for a previous year should not be entered. Therefore, the amounts on lines 1, 2a, 3 and 4 will no longer be calculated using Form COMP5 (Jump Code: COMP5).

Moreover, to allow you to present more columns in the tables, where required, the Add button has been added at the beginning of Part 1.

If you completed this form using a previous version of the program, review the entire form before filing it, as data will not be transferred to the new version of the program.

T183, Information Return for Electronic Filing of Trust Return (Jump Code: T183)

This new form allows you to obtain an authorization to EFILE a trust tax return. The information in Parts A to D should be completed before having the form signed in Part E. Before EFILING the return, answer the question Was Form T183 electronically signed? in the Electronic signature section. If the answer is Yes, enter the electronic signature date and time.

Options have been added to Part F in the Profile tab of the preparer profile to indicate whether you intend to use an electronic signature method and whether you want to print the form with or without the information and instructions page. These choices will be reflected in the Information from Preparer Profile section at the top of Form T183.

TP-768.1, Recovery Tax – Qualified Disability Trust (Jump Code: Q768.1)

As a result of changes made to Form T3QDT-WS (jump code: T3QDT-WS), the columns from previous tax years have been removed from Form TP-768.1. Therefore, the amounts on lines 800 and 801 will no longer be calculated using Form QCOMP5 (jump code: QCOMP5).

If you completed this form using a previous version of the program, review the entire form before filing it, as the data will not be transferred to the new version of the program.

Version 1.0 Content

Modifications

Mandatory Electronic Filing Threshold

In its April 19, 2021 Budget, the Government of Canada announced its intention to lower the mandatory electronic filing threshold of income tax information returns from 50 to 5 returns. However, note that this measure is not yet in force. For the latest information, refer to the CRA Web site at canada.ca/mandatory-electronic-filing. You can also subscribe to their Electronic Filing of Information Returns e-mail distribution list at canada.ca/cra-email-lists.

ID, Trust Identification and Other Information (Jump Code: ID)

The CCH Practice integration has been removed from the program. As a result, this integration option has been removed from the Options and Setting dialog box and the CCH Practice section in Form ID (Jump Code: ID) has also been removed.

If you would like to enter CCH Practice-related information in the client file, we suggest that you use one of the fields available in the program that will be retained when rolling forward the client file. For example, user-defined cells at the bottom of Form ID (Jump Code: ID).

In addition, certain code numbers in the Type of trust list have been changed to be up to date with those in the 2020 version of guide T4013. When opening a file created with a prior version of the program, the former trust code will be replaced with the new one, if the code is part of the following list:

|

Types of Trusts |

Former Codes |

New Codes |

|

Testamentary spousal or common law partner trust |

001 |

905 |

|

Tax-free savings account (TFSA) |

32 |

320 |

|

Employee life and health trust (ELHT) |

33 |

321 |

|

Spousal or common-law partner trust |

11 |

322 |

|

Unit trust |

12 |

323 |

|

Mutual fund trust |

13 |

324 |

|

Communal organization trust |

14 |

325 |

|

Employee benefit plans trust |

15 |

326 |

|

Insurance segregated fund—fully registered trust |

161 |

327 |

|

Insurance segregated fund—partially registered trust |

162 |

328 |

|

Insurance segregated fund—non registered |

163 |

329 |

|

Non-profit organization trust—subsection 149(5) trust |

180 |

330 |

|

Non-profit organization trust—subsection 149(1)(I) trust |

181 |

331 |

|

Employee trust |

19 |

332 |

|

Blind/revocable trust |

20 |

333 |

|

Personal trust |

21 |

334 |

|

Joint spousal or common-law partner trust |

22 |

335 |

|

Alter ego trust |

23 |

336 |

|

Master trust |

24 |

337 |

|

Specified income flow-through trust (SIFT) |

28 |

338 |

In addition, options have been added to the Information regarding Québec section to indicate that the trust is eligible for a temporary exemption, which allows the trust not to enter its account number or identification number on the RL-16 slips, provided the trust has not yet obtained these numbers.

Schedule 1, Dispositions of Capital Property (Jump Code: 1)

Line 1101, T5, T4PS, and T5013 information slips – Capital gains (or losses), has been added to Schedule 1 so that the capital gains (losses) from T3 slips are updated to 1100 and the capital gains (losses) from T5, T4PS and T5013 slips are updated to line 1101.

Schedule 11A, Donations and Gifts Tax Credit Calculation (Jump Code: 11A)

Following the update of the form, line 14A has been renumbered line 15. Given that donations carried forward from taxation years ending in 2015 are now expired, only the amounts of ecological gifts made after February 10, 2014, and before 2016 should now be entered on line 15.

Client letters and Client Letter Worksheet (Jump Code: LW)

To resolve a display problem with date fields in the paragraphs, we replaced the second date fields which were protected with new protected fields in the following sections of the Client Letter Worksheet form:

- Identification of trust

- T3 return (Paper/Internet)

- RC4649 – Country-by-country report

- Québec – Paper-filed return

- Taxation years and filing date

In addition, we have also replaced all date fields that were used in the Client letter, Trust return filing instructions (Jump Code: LETTER), QC Client letter, Trust return filing instructions (Jump Code: QLETTER), Client letter, Additional letter (Jump Code: ACL1 to ACL5), Client letter, Notice to Reader (Jump Code: NOTICE) and QC Client letter, Notice to Reader (Jump Code: QNOTICE). Adjust your customized letters, if necessary.

LM-15, Voluntary Disclosure (Jump Code: QLM15)

The mailing address for the form has been changed. For the new address, consult the Help of this form.

RL-16 slip, Trust Income (Jump Code: QR16)

The Trust Account Number field has been added to the RL-16 slip. Note that for the information in this new field to be displayed on the printed version of the slip, it must be entered in the field for that purpose in the Information regarding Québec section of Form Identification (Jump Code: ID).

T3, Trust Income Tax and Information Return (Jump Code: J)

As a result of an update of the form, trusts are now required to provide the name of an individual as a contact person if the primary contact is not an individual. In addition, a drop-down menu has been added to allow you to select the province if the trust carried on a business during the year. Finally, line Other deductions in the Step 4 – Calculating taxable income section and line Other credits in the Step 5 – Summary of tax and credits section have been split to allow for a more detailed data entry. Note that you can now enter specific provincial tax credits in the latter section. If an amount of provincial tax credits has been distributed to beneficiaries, you can enter the distribution amount on the T3 slip (included in box 45).

T3M, Environmental Trust Income Tax Return (Jump Code: T3M)

As a result of an update, the form underwent significant changes. You must now indicate the first and last name of the contact person as well as the mailing address if the latter is different from the trustee’s address in the Trustee information section. In addition, the question Is this the first year the trust is filing a tax return? has been added to the Information about the trust section. Finally, box 102, Refund Code, has been added to the Income and tax payable section.

If you completed this form using a previous version of the program, we recommend that you review the content of the form before filing it.

T3-RCA, Retirement Compensation Arrangement (RCA) Part XI.3 Tax Return (Jump Code: T3RCA)

As a result of an update, the form underwent significant changes. You must now indicate whether the custodian is an individual (option 1) or a non-individual (option 2) and only complete the corresponding information in the Custodian information section.

If you completed this form using a previous version of the program, we recommend that you review the content before filing the form.

T1134, Information Return Relating to Controlled and Non-Controlled Foreign Affiliates (Jump Code: 1134)

A new version of Form T1134 for taxation years starting after 2020 has been integrated into the program and only displays when the taxation year covered by the return starts on January 1, 2021, or after. For taxation years starting prior to this date, the previous version of the form must be used.

The new version of the form provides the ability, for a group of reporting entities that are related to each other, to file as a group. The information related to individuals, corporations, trusts and partnerships that are part of this related group must be indicated in new subsections A and B in Section 3 of Part I. Note that the taxation year-end date or fiscal year-end date must be the same for all entities in the group. In addition, if an election to use functional currency was made, individuals and trusts cannot be part of the group.

In the new subsection C in Section 3 of Part I (which corresponds to former Section 3 of Part 1), the question Is the reporting entity submitting a group organizational chart for the required information noted in C. (i) through (iv)? will allow you to submit an organizational chart if it contains the required information.

Several tables have been added to the form to allow for the filing of the return by a group of related entities. Therefore, entities in the group that are indicated in subsection A of Section 3 in Part I will be used to form a list from which you will be able to select the relevant entities in the tables of the T1134 Supplement section.

The layout of the form has also been revised and a lot of information that was already requested in the previous version of the form has been incorporated into the new tables. When opening a return prepared with a prior version of Taxprep for Trusts in which the taxation year starts after 2020 or when rolling forward a client file in which the taxation year after roll forward is the first year starting after 2020, data entered in the previous version of the form will be retained in the corresponding fields of the new version of the form, where applicable.

Finally, if you completed Form T1134 for a year beginning after 2020 with a prior version of Taxprep for Trusts:

- The amounts that were entered in the table in Section 2 of Part III will be rounded to the nearest thousand, then retained on the corresponding line in the column Total gross revenues (all sources) in the table of Section 2 in Part III. Currency codes will also be retained on the corresponding lines.

- If an amount was entered on one of lines (i) to (viii) in Section 3 of Part III, it will be retained on the corresponding line among lines in table (iv) of Section 3 in Part III, in column FAPI if it is positive or in columns FAPL or FACL as an absolute value if it is negative.

We strongly suggest that you review the entire form before filing it.

T3NL, Newfoundland and Labrador Tax (Jump Code: T3NL)

T3NLMJ, Provincial Tax (Multiple Jurisdictions) – Newfoundland and Labrador Tax (Jump Code: MJ NL)

In its budget tabled on May 31, 2021, the Government of Newfoundland and Labrador announced the addition of three tax brackets and the increase in the tax rate of the 4th and 5th tax brackets for the 2022 and subsequent taxation years. Therefore, the tax brackets for Graduated Rate Estates (GRE) and Qualifying Disability Trusts (QDT) will be the following:

|

Brackets |

Rates |

|

$39,147 or less |

8.7% |

|

More than $39,147 but not more than $78,294 |

14.5% |

|

More than $78,294 but not more than $139,780 |

15.8% |

|

More than $139,780 but not more than $195,693 |

17.8% |

|

More than $195,693 but not more than $250,000 |

19.8% |

|

More than $250,000 but not more than $500,000 |

20.8% |

|

More than $500,000 but not more than $1,000,000 |

21.3% |

|

More than $1,000,000 |

21.8% |

As for the tax rate for trusts other than GRE and QDT, it has been increased from 18.3% to 21.8%. In addition, the credit rate for donations over $200 has also been adjusted to 21.8%.

T3PE, Prince Edward Island Tax (Jump Code: T3PE)

As a result of the update of the form, line 28, Allowable political contribution tax credit, and the corresponding table and lines have been deleted as the definition of “Individual” was amended by Bill 58. Therefore, the tax credit is no longer available to estates or trusts. Finally, because of these changes, several lines of the form have been renumbered.

If you completed this form using a prior version of Taxprep for Trusts, we strongly suggest that you review the entire form before submitting it.

T3S, Supplementary Unemployment Benefit Plan Income Tax Return (Jump Code: T3S)

As a result of an update, the form underwent significant changes. You must now indicate whether the trustee is an individual (option 1) or a non-individual (option 2) and only complete the corresponding information in the Trustee information section. In addition, a new question regarding the T3 Trust Income Tax and Information Return has been added to the Information about the trust section. Finally, box 102, Refund Code has been added to the Summary of tax or refund section.

If you completed this form using a previous version of the program, we recommend that you review the content before filing the form.

TP-646, Trust Income Tax Return (Jump Code: Q)

Part 6, Additional information about the trust, has been added to the TP-646 return to report the beneficial ownership of the trust. This section will be completed using information from Form BENEF (Jump Code: BENEF). Note that you can enter additional entities on the TP-646 return.

In its 2018 Budget, the CRA proposed to administer the new beneficial ownership reporting requirements of a trust. However, as the legislative changes have not yet received Royal Assent, this proposition was put on hold. As for Revenu Québec, they confirmed that they would retain Section 6 of the TP-646 return. However, they decided not to make it mandatory to complete this section for the 2021 taxation year. A box has been added to Section 6 to allow you to make this election.

Schedule G, Additional Information – Trust Resident in Québec That Owns a Specified Immovable (Jump Code: QG)

As a result of an update, subsection 1.3, Persons who can exert control over the trustee’s decisions, has been added to the form. In addition, the date of birth must now be provided.

Technical Information

Technical Changes

Electronic transmission of the T3 Trust Income Tax and Information Return using EFILE

Effective as of February 21, 2022, the CRA made available the electronic transmission of the T3 Trust Income Tax and Information Return using EFILE. As a result, you will require an EFILE number as well as a password to electronically transmit a T3 return. Please note that you can no longer use the CRA’s Filing by Internet file transfer (XML) service to electronically transmit a T3 return, as this type of transmission has not been supported by the CRA since December 23, 2021.

To that end, and to make the T3 EFILE available, several modifications have been made in Taxprep for Trusts:

- The Electronic Services/Identification – EFILE section has been added to the Options and Settings dialog box. This will allow you to enter your EFILE number and password used to transmit T3 returns.

- The Transmit dialog box has been added to the program. To access it, from the toolbar menu, click Transmission/General Returns/Transmit. This will allow you to select the client for whom you want to transmit the T3 return and display the EFILE status for the return.

- The EFILE Transmission Results dialog box has been added to the program. It is automatically displayed following the transmission of a T3 return or by clicking Transmission/General Returns/EFILE Transmission Results. This box will indicate whether the T3 return has been accepted by the CRA or an error occurred.

- Finally, the filter EFILE Eligible – T3 Return has been added to the filters of the Client Manager view. This will allow you to display all client files in which a T3 return is EFILE eligible.

Attach file

The Attached Files tab of the Properties dialog box now provides a link to open the new Attached Files dialog box. Note that the Attached Files tab will be removed from the properties box in a future version of Taxprep. You can also open the Attached Files dialog box from the File/ Attached Files menu or yet, by clicking the ![]() icon on the toolbar or by pressing the Ctrl+F11 hotkey.

icon on the toolbar or by pressing the Ctrl+F11 hotkey.

The new Attached Files dialog box includes a grid allowing you to display all files attached to the client file. The ![]() icon allows you to open the Attached files properties dialog box. In this box you will, among other things, be able to embed the attached file in the client file or link the former to the client file.

icon allows you to open the Attached files properties dialog box. In this box you will, among other things, be able to embed the attached file in the client file or link the former to the client file.

Finally, the Attached Files section has been added to the Options and Settings. This section allows you to select the default method used to attach a file (embedded or linked).

For more information about attached files, consult the topic Attach file.

AnswerConnect integration

AnswerConnect can now be used with the Taxprep InfoConnect feature. To that end, modifications have been made to the Options /Tax Research section of the Options and Settings. The IntelliConnect options subsection has been replaced by the Options related to the tax research platform subsection. In addition, the box Free trial as well as the IntelliConnect login information have been removed from this section.

To use AnswerConnect with the InfoConnect functionality, in the Options related to the tax research platform subsection, make sure that the check box Display InfoConnect is selected and select the AnswerConnect radio button. Note that the AnswerConnect option is selected by default.

Note that once this option is selected, a dialog box will be displayed when opening Taxprep to allow you to log in to AnswerConnect. In addition, if you close this box without entering the AnswerConnect login information, the option Show InfoConnect will be cleared in the Tax Research section of the Options and Settings.

All custom letters are now supported for digital signature

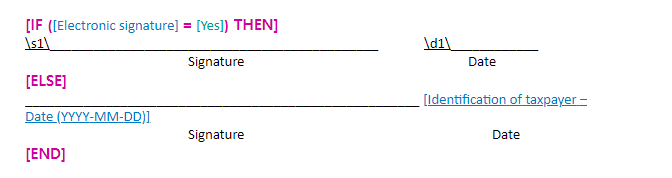

Previously, only the Engagement letter was supported for digital signature. Now, all custom letters can be digitally signed. Customer letters do not have default e-tags integrated. To add an e-tag, you can copy digital signature tags from the Engagement letter and, where applicable, make the required adjustments. Here is the Digital Signature section in the Engagement letter:

Where:

\s1\ corresponds to the e-tag; and

\d1\ corresponds to the date of signature.

Where to Find Help

If you have any questions regarding the installation or use of the program, there are several options for getting help. Access the Professional Centre or the Knowledge Base for tips and useful information on how to use the program. If you are in the program and need help, press F1 to get help on a specific topic.

Taxprep e-Bulletin

For your convenience, you are automatically subscribed to the Taxprep e-Bulletin, a free e-mail service that ensures you receive up-to-date information about the latest version of Taxprep for Trusts. If you want to review your subscription to Taxprep e-Bulletin, visit https://support.wolterskluwer.ca/en/ and, in the Newsletter tab, select Subscription Manager.

You can also send an e mail to cservice@wolterskluwer.com to indicate the products for which you want to receive general information or information on our CCH software (Personal Taxprep, Corporate Taxprep, Taxprep for Trusts, Taxprep Forms or CCH Accountants’ Suite).

How to Reach Us

Customer Service:

cservice@wolterskluwer.com

Tax and Technical support:

csupport@wolterskluwer.com

Telephone

1-800-268-4522